Scholarship VS Grant VS Loans: Tips To Managing College Finances

Topics Covered

Click To Jump To A Specific Section

Get More Help

Other Educational Reources

Browse personalized mentoring / coaching options or documents / templates that fit the needs of any student

With all of the talk about handling your student debt, getting scholarships, and taking out loans, your college finances can be very intimidating, especially if you don’t have a parent or guardian to help you. In reality, taking out loans, applying for scholarships, and making payments is the easy part as long as you know the basics and you’ve already completed FAFSA. Here are some tips to keep you ahead of the game in college and pay as little as possible for your education.

Applying for Scholarships

- Scholarships are sums of money, a sort of donation, that you can apply for in order to cover your college expenses, including textbooks, housing, and other aspects that are necessary to your education

- How you win scholarships:

- Merit-based scholarships: These are based off of merit, or who deserves it the most based on what they’ve accomplished with the resources they’ve been given. Anybody can apply for these. When you’re writing your essays and filling out your application, you’ll want to tell them about what you’ve accomplished and what your circumstances are (if they benefit your story). You might think that you’re not eligible because you come from a bad family or live in an underprivileged area, but your achievements are all relative to the environment you went to school/lived in, so chances are, you have a better story to tell than you might think. At the same time, you want to keep your tone humble and be appreciative of the opportunities you’ve been given.

- Need-based Scholarships: These are based off of need and the financial and environmental factors that impact you. Like merit-based scholarships, you’ll also want to talk about what you’ve achieved, but you should focus more on saying why you need the money and what you’d accomplish with it. These can often be divided based on your circumstances. For example, you might see special scholarships for handicapped students or students with a parent who is a veteran or has died in service.

- Merit-based scholarships: These are based off of merit, or who deserves it the most based on what they’ve accomplished with the resources they’ve been given. Anybody can apply for these. When you’re writing your essays and filling out your application, you’ll want to tell them about what you’ve accomplished and what your circumstances are (if they benefit your story). You might think that you’re not eligible because you come from a bad family or live in an underprivileged area, but your achievements are all relative to the environment you went to school/lived in, so chances are, you have a better story to tell than you might think. At the same time, you want to keep your tone humble and be appreciative of the opportunities you’ve been given.

- Who gives them to you:

- Your school: Generally, it will set aside a sum of money to give students who show extraordinary need or merit as an incentive for them to attend the school. These will be automatically handed out within your financial aid package. There are also some you have to apply for and more specific ones like departmental scholarships, but you just have to look them up on your school’s website to see what’s available. Some schools even have a departmental application that allows you to be considered for a majority of the available scholarships in your department, so be sure to look for that opportunity on your department’s webpage.

- Private sources like companies, organizations, and foundations: These scholarships can be very specific so you have to find the right one for you. It’s easiest to use a scholarship compiler that has filters to sort out the ones that you aren’t a good match for. Some foundations will give them out to anybody so you don’t have to worry about restrictions. However, some will be specific, only allowing you to apply if your parent worked for a certain company, you have a certain disability, you’re a certain race, or you have certain hobbies.

Loans, Grants, and Work Study

- Loans: money that is borrowed and repaid to the lender, often with interest.

- Grants: money that is given to you, much like a scholarship.

- Work Study: a program that takes money off your bill if you take anon-campus job such as being a teaching assistant or working in the dining hall.

- You may see all 3 of these terms, as well as scholarships, on your financial aid package. Your financial aid package is prepared for you based on your FAFSA information and your college application. If you haven’t already completed FAFSA, here’s a linkto our guide. As long as you’ve filled out your FAFSA and your application, you’re automatically considered for all of these financial benefits, including federal loans and grants.

- Your financial aid package includes:

- Subsidized loans: federal government loans that don’t rack up interest while you’re still in school (these are the most favorable loans and should be taken first).

- Unsubsidized loans: federal government loans that DO rack up interest while you’re still in school.

- For subsidized and unsubsidized loans: your allowance will grow over the next 4 years. You might have to seek other loans in addition to these at first but eventually your subsidized and unsubsidized loans will cover a bigger and bigger portion of your expenses.

- Any scholarships you were automatically awarded during the application process (these don’t require applications; they use your college application to evaluate you for them).

- Grants: these are usually special or federal offerings based on special circumstances or need. The most common one is the federal Pell Grant which is given to students that demonstrate significant need and doesn’t need to be paid back.

- Estimated family contribution: This is a number that FAFSA comes up with and the school uses to determine how much of your remaining costs your family can afford to pay out of pocket. It’s usually a big sticker shock to see what FAFSA thinks your family contribution should be, but that’s normal. If your family contribution looks ridiculous then you’ll probably need to apply for other loans such as a Parent PLUS loan.

- The traditional estimated expenses for the school.

- You have all these additions and subtractions, now what?

- The financial aid package likely does this for you, but you should manually add up the expenses and benefits. All of your benefits, scholarships, loans, grants, family contribution, and work study credits will be positive while the school expenses will be negative.

- The only aspect of the equation that is out of pocket and is significant to you or your parent’s current financial situation is the family contribution. If they list the family contribution, it will likely be the amount of money needed to cover the expenses after your benefits are taken out. If they don’t list it, then you owe nothing or the sum of your benefits and expenses will be negative and that number will be your family contribution.

- If your family contribution is too much money for you or your parents to afford, then it’s time to apply for more scholarships or take out an external loan.

- There are all kinds of special loans like the Parent PLUS loans (an additional federal loan) and private bank loans. What you want to look at is the restrictions on who can apply for them and the interest rates. The interest rates usually come in a range based on your family’s credit rating. What you’re looking for is the lowest possible interest rate to reduce the total amount of money you owe to the lender. You might also see a difference in fixed vs. variable rates. Fixed rates are better if market interest rates are at a relative low point and variable rates are good if market interest rates are at a high point and show evidence of declining. If you’re not experienced with fixed and variable interest rates, it’s usually safest to go with a fixed rate so you know for sure that’s what you’ll be paying.Once you find one, you’ll have to fill out their application and wait to see if you get accepted. If you keep getting denied, it’s usually based on credit. This means you’ll have to take out a higher interest loan because in the loan distributor’s eyes, you appear to be a risk, so you need to offer more interest to them for it to be a profitable exchange.

- Once your benefits and expenses are balanced and your family contribution comes out to a reasonable number, you’re all set. You can accept your financial aid package and choose what portion of the subsidized and unsubsidized loans you want to use. You’ll likely have to fill out a Master Promissory Note (MPN)to complete the process. This is a legal document where you accept the terms and conditions of your loans and agree to face the consequences of not paying them back in a timely fashion.

- You aren’t required to accept any loans.If you want to decline the loans and pay out of pocket, then you’re free to do so. Likewise, if you want half of the offered loans or you only want the subsidized loans, you can do that as well.

- Be sure to keep up on when your financial aid needs to be renewed. FAFSA needs to be filled out once a year, which your school will remind you of. This covers scholarships, federal loans, grants, and more items. The other renewal you need to watch out for is private loans,as they might follow a different schedule.

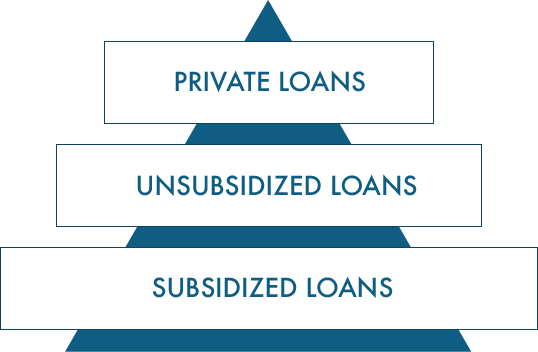

- Loan quality looks like this, from most favorable to least favorable in terms of interest and risk:

Making Payments

Congratulations, you got the money! Whether it’s from scholarships, aid, or your parents, you need to put it to use. Here’s how you go about doing that:

- Your balance sheet and payment options will be found in your school financial aid portal.

- The balance sheet is fairly self-explanatory once you’ve planned your finances as described above. Your bill will look like your financial aid package did, with benefits and expenses showing up as additions for your benefits and subtractions for your expenses.

- Your loans, grants, and scholarships may not show up right away, but keep an eye on it and make sure you’re getting exactly what you were awarded before it’s time to pay. There will be a resulting number at the bottom of this balance sheet. If it’s a positive number, then the school owes you money. If it’s a negative number, then that’s what you owe. Or, it might be zero if you planned for loans to cover everything or if you have already made your payment and have been reimbursed.

- If you agree with the number and need to make a payment, proceed to the payment portion of the financial aid portal and pay just like you would if you were shopping online.

- If you have questions about certain expenses or disagree with the number shown, then call the financial aid office and have them take a look at it.

- If you need to be reimbursed, then the financial aid office should contact you or there should be a place to get your refund on the portal. This is similar to doing taxes. You see whether you underpaid or overpaid on your taxes and end up either getting a tax refund or paying the rest of what you owe depending on how the number works out.

- A couple things to be careful of:

- The numbers might change a little or look weird towards your later years of college. The main things that change are the additional costs and the loan amounts. Your federal loans will increase each year, which is good for you because you might not even need your private loan by your junior or senior year. However, something to look out for is additional costs. Sometimes, things like lab fees and parking permits go on your balance sheet, but there are a lot of things that can mess it up. If you opt for more expensive housing or a nicer dining plan, then you might see some higher numbers that you need to account for. Likewise, you might have to pay differential tuition after your first couple years which is a fancy way of saying that you picked a major with high maintenance costs, such as labs and wood shops, and you’re responsible for contributing to them.

- Financial aid is often split into semesters or combined into a yearly overview depending on what source you’re looking at, so don’t be surprised if the numbers look randomly halved or doubled, just make sure it corresponds to the time period the payment is looking at.

Sean Fowler

Writer

Our writers are always current students to ensure our guides are applicable and relevant. Click on the writer’s name above to learn more about them!

EP Enterprise

Our Team

It takes a team to build and power this platform! Check out our full team by clicking the platform name above.